2022 Federal Budget Highlights

Federal Budget 2022 – Highlights

On April 7, 2022, the Federal Government released their 2022 budget. We have broken down the highlights of the financial measures in this budget into the following different sections:

-

Housing

-

Alternative minimum tax

-

Dental care

-

Small businesses

-

Tradespeople

-

Canada Growth Fund

-

Climate

-

Bank and insurer taxes

Housing

There were several tax measures related to housing introduced in the budget.

Budget 2022 introduced a new kind of savings account – a Tax-Free First Home Savings Account (FHSA).

These are the key things you need to know about the new FHSAs:

-

You must be at least 18 years of age and a resident of Canada to open an account. You must also not currently own a home or have owned one in the previous four calendar years.

-

You can only open and use an FHSA once, and you must close it within a year after your first withdrawal.

-

Contributions are tax-deductible, and income earned in an FHSA will not be either while it is in the account or when you withdraw it.

-

There is a lifetime contribution limit of $40,00, with an annual contribution limit of $8,000. You can’t carry contribution room forward.

-

If you don’t use the funds in your FHSA within 15 years of opening it, you can transfer them to an RRSP or RRIF tax-free. Transfers to an RRSP do not impact your RRSP contribution room.

Two existing tax credits were increased, and a new one was introduced:

-

The First-Time Home Buyers’ Tax Credit amount was increased from $5000 to $10,000, giving up to $1,500 in direct support to home buyers. This tax credit applies to all homes purchased on or after January 1, 2022.

-

The annual expense limit for the Home Accessibility Tax Credit has been increased to $20,000 for 2022 and subsequent tax years.

-

A new tax credit, the Multigenerational Home Renovation Tax Credit, was introduced, which will start in 2023. This tax credit is a 15% refundable credit for eligible expenses up to $50,000 (maximum tax credit is $7,500) for constructing a secondary suite for a senior or an adult with a disability to live with a qualifying relative.

Budget 2022 proposes new rules, effective January 1, 2023, that anyone who sells a residential property they have held for less than 12 months would be subject to full taxation on their profits as business income. However, there will be some exemptions to these rules due to life events such as a death, disability, the birth of a child, a new job, or a divorce.

Budget 2022 also announces restrictions that would help ensure that Canadians, instead of foreign investors, own housing. A two-year ban will be introduced on non-residents buying residential property, with some exceptions, such as individuals who have work permits and are living in Canada.

Alternative Minimum Tax

In Canada, the top federal tax rate is 33% and starts at an income of $221,708. However, many high-income filers end up paying less tax than this due to tax deductions and tax credits.

The goal of the Alternative Minimum Tax (AMT), which has been around since 1986, is to ensure high-income Canadians are paying their fair share of taxes. However, it has not been substantially updated since it was introduced. In Budget 2022, the government indicated they would be investigating changes to the AMT, which will likely be disclosed in the fall 2022 economic update.

Dental Care

For many Canadians without private coverage, going to the dentist is too expensive. Budget 2022 commits $5.3 billion to provide dental care for Canadians with family incomes of less than $90,000 annually. Coverage will start for children under 12 this year and expand to children under 18, seniors and those living with a disability in 2023, with the program will be fully implemented by 2025.

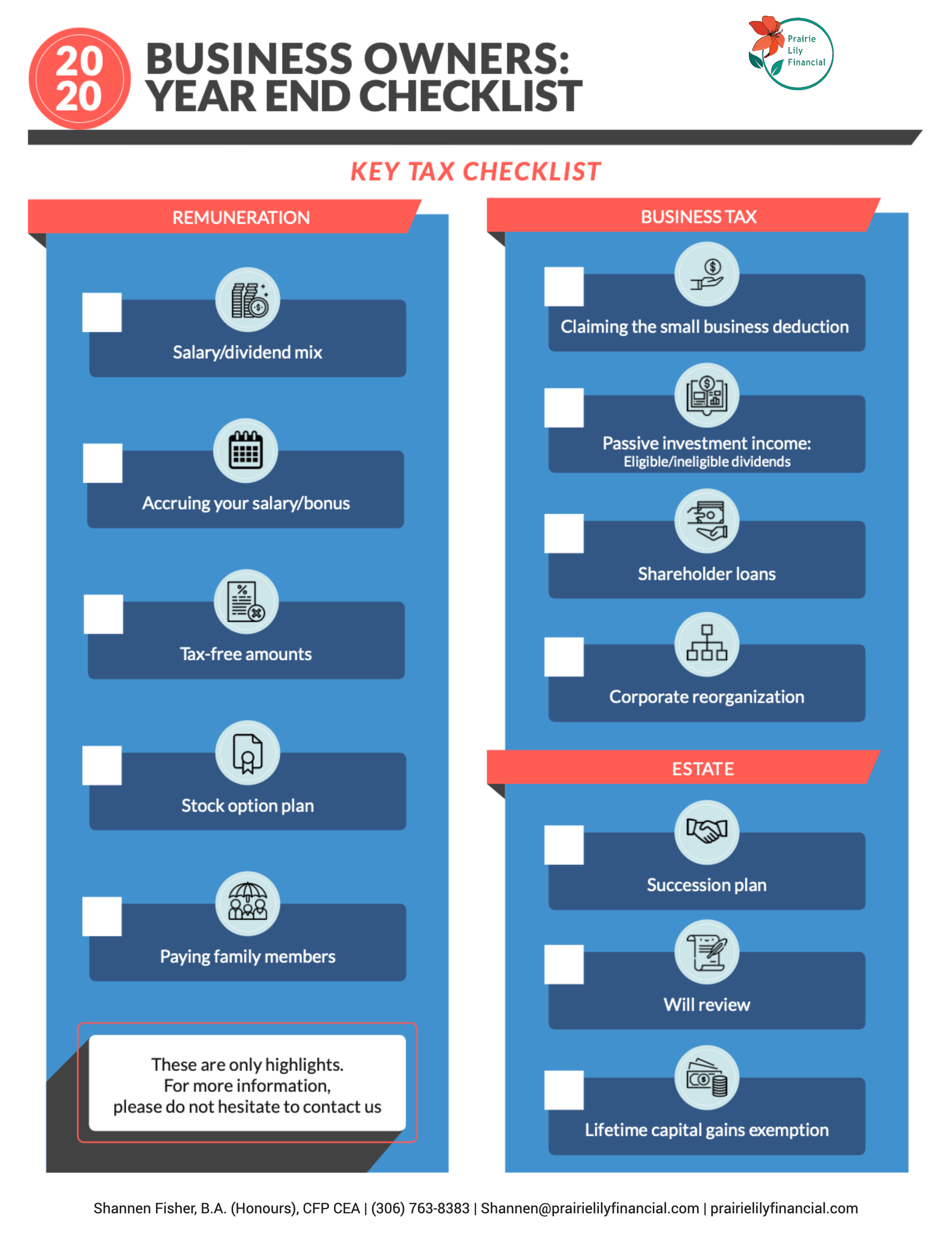

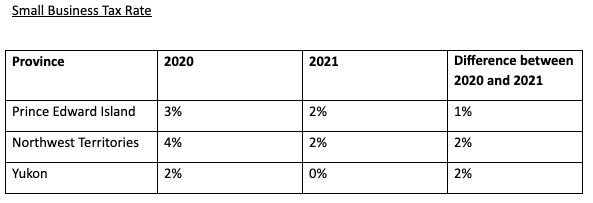

Small Businesses

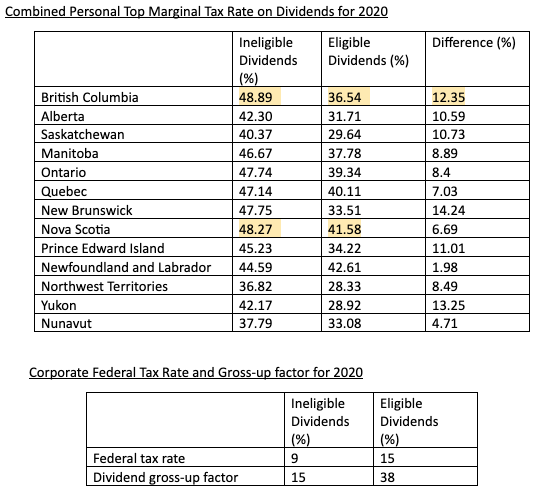

Small businesses currently have a 9% tax rate on the first $500,000 of taxable income (compared to the corporate tax rate of 15%). However, after a small business’ capital employed in Canada reaches $15 million, it is no longer eligible for the 9% tax rate.

Budget 2022 proposes gradually phasing out the small business tax rate so that businesses are not discouraged from expanding. The new cut-off for the lower tax rate will be $50 million.

Budget 2022 also includes a proposal to create an Employee Ownership Trust. This would be a new, dedicated trust under the Income Tax Act to support employee ownership.

Tradespeople

Budget 2022 introduces the Labour Mobility Deduction. This would allow eligible tradespersons and apprentices to deduct up to $4,000 a year in eligible travel and temporary relocation expenses.

Budget 2022 also commits to providing $84.2 million over four years to double funding for the Union Training and Innovation Program, which would help 3,500 apprentices from underrepresented groups each year.

Canada Growth Fund

Budget 2022 introduces a new Canada Growth Fund, with the goals of both diversifying our economy and helping achieve our climate goals.

The Canada Growth Fund aims to attract considerable private sector investment, support the restructuring of vital supply chains, and bolster our exports. The Canada Growth Fund will also provide backing to reduce our emissions and invest in the growth of low-carbon industries.

Climate

Budget 2022 continues to confirm the government’s commitment to fighting climate change. It commits $1.7 billion over five years to extend the Incentives for Zero-Emission Vehicles Program until March 2025 and also provides funding to create a national network of electric vehicle charging stations.

Budget 2022 also commits $250 million over four years to support the development of clean electricity, including inter-provincial electricity transmission projects and Small Modular Reactors.

Bank And Insurer Taxes

Budget 2022 introduced a new financial measure called the Canada Recovery Dividend. Banks and insurers will have to pay a one-time, 15% tax on 2021 taxable income above $1 billion. This tax will be payable over five years.

Budget 2022 also proposes increasing the tax rate on income above $100 million for banks and insurers to 16.5% (currently 15% for other corporations).

Wondering How This May Impact You?

If you have any questions or concerns about how the new federal budget may impact you, call us – we’d be happy to help you!

-Shannen%20-Fisher-kPvmA29PjKFr8LNQE.png)