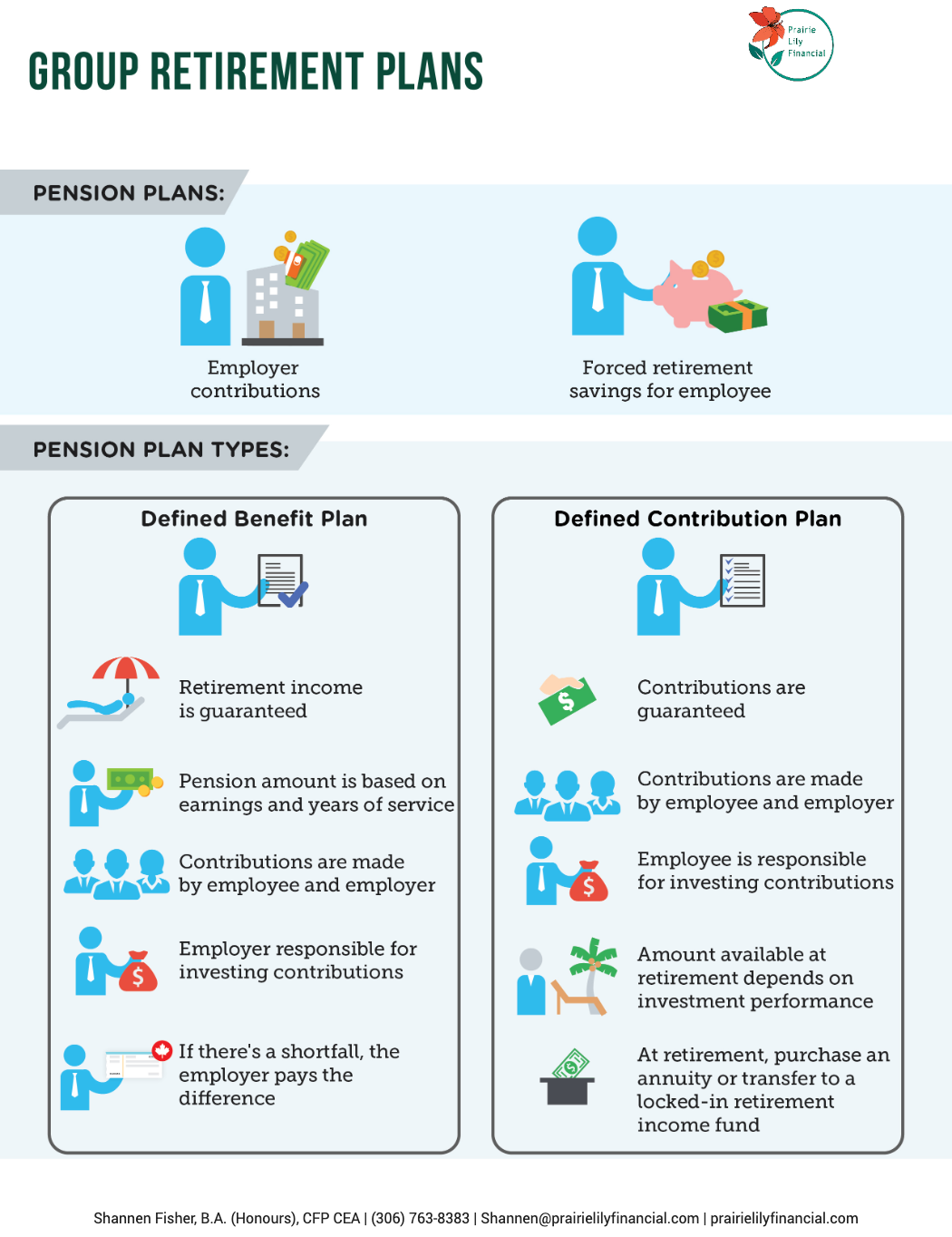

Group Retirement Benefits

Working at an organization that offers a pension plan is one of the greatest financial advantages a Canadian can enjoy. Pension plans are designed to provide retirement income and help employees reach their retirement goals and for business owners- help retain key employees.

Pension plans can offer:

-

Employer contributions

-

Forced retirement savings for employee

There are 2 main types of pension plan:

-

Defined Benefit Plan

-

Defined Contribution Plan

Defined Benefit Plan

-

Retirement income is guaranteed, contributions are not.

-

The pension amount is based on a formula that includes the employee’s earnings and years of service with the employer

-

Usually, contributions are made by the employee and employer

-

The employer is responsible for investing the contributions to ensure there’s enough money to pay the future pensions for all plan members.

-

If there’s a shortfall, the employer pays the difference.

Defined Contribution Plan

-

Contributions are guaranteed, retirement income is not.

-

Usually, contributions are made by the employee and employer.

-

The employee is responsible for investing all contributions.

-

The amount available in retirement depends on how the investment performs including total contributions.

-

At retirement, the money in the account can be used to generate retirement income through purchasing an annuity or transferring the amount to a locked-in retirement income fund.

In summary, a defined benefits plan guarantees you a retirement income and a defined contribution plan guarantees contributions but not retirement income.

Talk to us, we can help.